FSI Incumbents Gonna Keep Incumbing

Also in this issue: The Allure of Developing Markets Remains for Digital Plays by FSIs, but the Window Is Closing

FSI Incumbents Gonna Keep Incumbing

After a year of working at American Express almost two decades ago, I pondered: if all of us at HQ stopped coming to work, would anyone notice? The franchise wielded such power, and our management and strategy activities appeared so inconsequential that it was difficult to discern their practical impact in the short term. This question resurfaced when I watched a 2022 video that recently went viral, depicting two product managers from a credit card company working from the pool:

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

The prevailing commentary aimed to mock them and predict that "AI," "Elon Musk," or some other force would eliminate such employees in the next few years. According to their logic, this work arrangement virtually guarantees imminent disruption, either by management to survive or by a startup with superior practices and novel technology. In a perfect market, every inefficiency is eliminated due to brutal competition for clients.

Should American Express feel the urgency to transform its operating model or face extinction due to fintech disruptors akin to digital natives like Amazon, Netflix, or Spotify?

Not only is the company doing great, but even those product manager roles haven’t changed much in decades. Yes, they have cooler names and there is more coordination among organizational silos, but they don’t act like "mini-CEOs" or enable direct access of engineers to customers.

There's no need for "Elon Musk" or “AI” to eliminate the product managers in American Express or other incumbent FSIs because they are already performing well enough with a slow evolution. For example, Fidelity has an army of "scrum masters" and "squad leaders," with many acting as glorified project managers. Could the company remove the bottom half of those without a significant business impact? Probably, but why bother when Fidelity is already performing so well compared to fintechs? Fifteen years since Betterment's launch, Fidelity still exceeds it by 100X in assets and 50X in the number of customers:

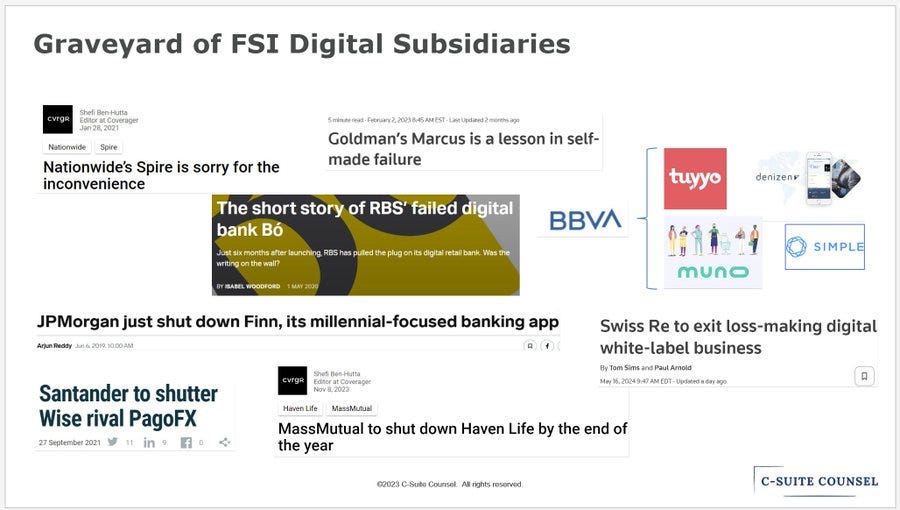

A practical way to think of incumbents versus startups is that the latter aren't strong enough to disrupt, while the former aren't strong enough to innovate. There are, of course, exceptions like Blackrock’s Aladdin, but Swiss Re is a more typical story.

A decade ago, its leadership might have thought, "Sure, our internal technology maturity is pretty basic, but wouldn't it be cool to spend a billion on a B2B2C platform business? And let's call it by a different cryptic name, iptiQ, than our 150-year-old globally recognized brand." This resulted in a predictable recent update: Swiss Re is looking to exit that business after losing $600 million in the last two years alone.

With that, Swiss Re is joining the long lineup of similar innovation failures among incumbent FSIs with no impact on the prosperity of their core businesses.

So, not being a leading innovator but also not being at risk of being disrupted means that incumbents will continue to thrive, and the catastrophizing directed at those credit card product managers is more wishful thinking. It mostly stems from an older generation who toiled away in the office and feels envious of younger people who have found a happier balance. If you are working for an incumbent FSI and can make six figures while working poolside, it doesn't get much better than that professionally.

The Allure of Developing Markets Remains for Digital Plays by FSIs, but the Window Is Closing

Disrupting developed markets for financial services and insurance is almost impossible. These days, the default path for fintechs is B2C -> B2B -> unprofitable vendor -> sold to profitable vendor.

Avoiding such a fate requires flawless execution rather than the “easy-win” assumption of many startups just because they are younger. Both Wefox and Lemonade were founded in 2015 to disrupt "the outdated, slow-moving insurance industry." They leveraged their superior velocity and modern technology to launch numerous products in multiple countries, leading to disruption, but with one nuance. Lemonade's stock is down 90% from its highs, and Wefox's new executive chairman and chief executive, Mark Hartigan, recently issued a dire warning to investors:

liabilities in Germany were "very significant and could introduce a large cash strain on the company… My key deduction is that Italy has been running on systematically false operating assumptions…and is now insolvent without ongoing Group cash support.”

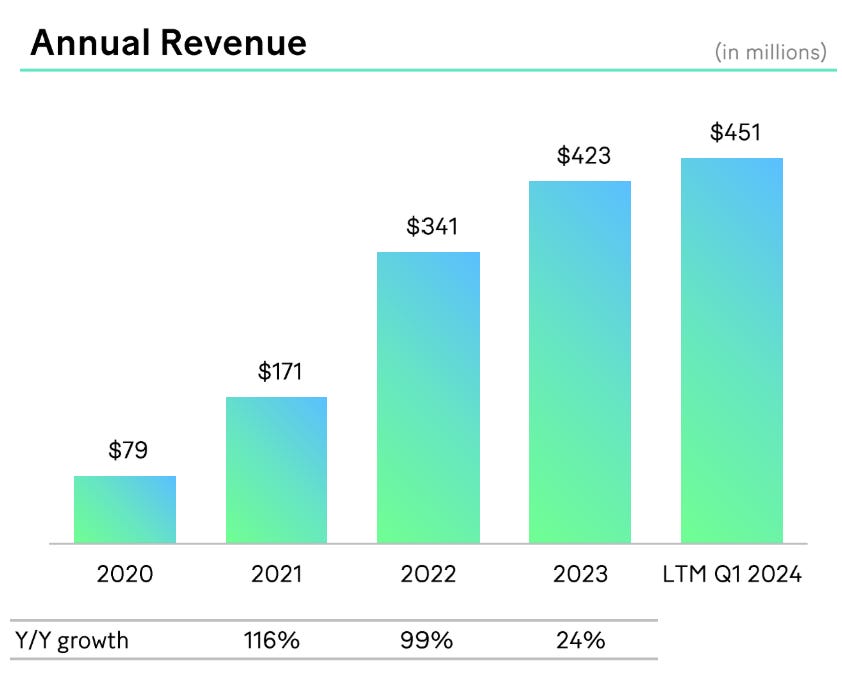

There are exceptions in developed countries like Cash App in the US, which generates more than $5 billion in annualized non-Bitcoin revenue while remaining profitable. The default expectation for these unique fintechs is that they are becoming more like traditional FSIs, just without a physical channel, with a growth rate falling to below 20% as they approach the top 10 incumbents. Some fintechs like SoFi or MoneyLion are still growing a bit faster for now, but only because they are much smaller:

There is still hope for one or two fintechs like Revolut to disrupt some developed countries as its growth accelerates, but it will take a few more years to prove sustainable unit economics. More interestingly, how much of that acceleration is due to developed versus developing markets? When Revolut launches in a country like Moldova, it immediately becomes among the top 5 finance apps. After almost a decade in its home market, the UK, it is still ranked #10 by usage. After four years in the US, its usage ranking is not even in the top 100.

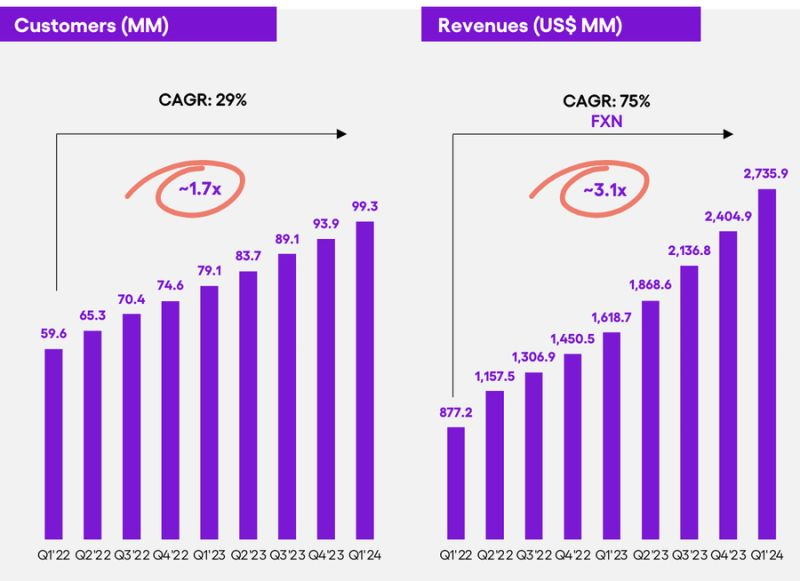

Developing countries were historically less competitive. Nubank capitalized on the difference in digital maturity among countries by starting in Brazil in 2013 and then expanding to Mexico and Colombia. In Q1, Nubank's revenue was already 60% of Itaú’s retail business while growing 15 times faster. If the trend continues, by next year it will be the largest consumer FSI in Latin America.

Equally impressive, Nubank's valuation is near Citi, a top-4 US bank with an on-the-ground presence in 95 countries. In a recent interview with

, Jag Duggal, Nubank’s CPO, explained the key macro reason behind its unprecedented success: consumers' hatred for incumbents in its target markets with huge pain points that could be addressed with digital-only solutions.But here lies the challenge for FSIs considering investing in Brazil on the consumer side today. Nubank has spent years addressing those pain points. Its leaders have superb attention to detail and intensity that a traditional FSI would struggle to match. Nubank has achieved 70-90% NPS across countries and a 50% Sean Ellis test score post-launch for new products. Unlike the wide-open field circa 2015, this new standard would be difficult to meet even for another fintech, as N26 discovered the hard way.

Similar examples exist in other large markets like China, India, and Russia. Tinkoff Bank (aka TCS) was founded in 2006 by a brilliant entrepreneur with a great team and a digital-native culture. In the most recent quarter, TCS generated $1.8 billion in gross revenue, growing at 66%, and with significant profitability. The leading traditional FSIs in those countries are also getting stronger, albeit more gradually, but in many cases by now, they are as capable as their counterparts in developed countries.

Each passing year sees the window of opportunity narrowing in developing markets for financial services and insurance products. Local incumbents, fintechs, and global players have long set their sights on larger, less corrupt countries. In due time, only markets of marginal significance or those governed by unenlightened dictators may remain untapped.