Beyond 'Smoke & Mirrors': FSIs Need Real Use Cases for Digital Transformations

Also in this issue - GenAI in FSIs: Balancing Customer Needs and Internal Complexities

Beyond 'Smoke & Mirrors': FSIs Need Real Use Cases for Digital Transformations

I first encountered the phrase "smoke and mirrors" at American Express after my time at McKinsey. It was already unsettling to realize that much of my consulting knowledge was irrelevant, but even more so to discover that advancing initiatives often relied less on facts and logic and more on overpromising impact and underestimating effort. I kept hearing about a highly successful Amex executive who excelled at this approach—securing approvals and buying time without facing accountability, as long as the outcomes were moderately positive. With Amex generating substantial profits, no one seemed concerned about the ROI of capability-building initiatives.

Digital transformation efforts in FSIs frequently follow similar “smoke and mirrors” tactics. Executives often prioritize trendy narratives over data-driven discussions, believing that overall earnings will offset any missteps. The decade-long push to the cloud exemplifies this trend. According to a recent Capgemini survey, 84% of FSI executives still cite operational efficiency as the primary driver of massive cloud investments. Yet, fewer than 40% achieve success, and only a third of those report reduced operational costs.

… Financial Services across a range of expectations, fewer than 40% said they were highly satisfied with cloud outcomes broadly; including reduced operational costs (33%), enhanced scalability (27%), accelerated innovation (26%), advanced data and analytics (24%), and improved security and compliance (21%).

That doesn’t seem to matter, as cloud spending has become the single largest non-interest expense category on many FSIs' financial statements after personnel. Leveraging hype to achieve broader objectives while relying on traditional methods to generate revenue isn’t unique to FSIs. In a recent ironic twist, Salesforce announced plans to hire 1,000 salespeople to sell AI Agents—tools supposedly designed to make sales teams more productive by offering “advanced reasoning abilities to handle tasks like resolving customer cases, qualifying leads, and optimizing marketing campaigns.”

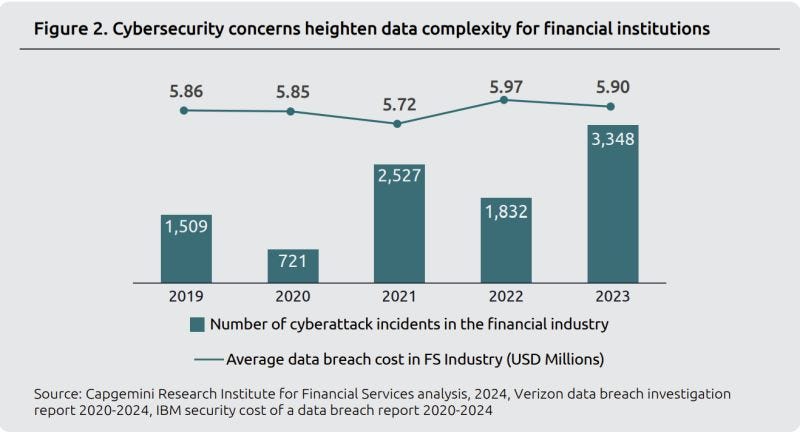

Naturally, I’m in the minority when advising FSI executives to use real use cases to justify digital transformation. While these may not drive lavish spending or rapid hiring, they are simpler to execute and offer better opportunities for learning compared to the black-box approach of massive, trendy initiatives. For instance, FSIs are locked in a relentless cyber arms race, requiring increased investment and operating model maturity to outpace sophisticated cybercriminal networks. With direct costs nearing $20 billion annually, the industry has a clear case for embedding cyber engineers into its most active cross-functional development teams.

For leading FSIs with cross-functional IT and data teams already in place, digital transformation is often justified by the need to accelerate revenue growth. This approach is inherently riskier, requiring significant investments to achieve meaningful impact, with no guarantee that end-users will adopt new digital products. In some markets, competitive pressure from fintechs further drives these moves. For example, Itaú Unibanco’s retail division revenue is now just 30% higher than Nubank’s. With Nubank growing 10 times faster at over 50%, it is on track to become the LatAm leader next year.

On the other hand, Chase might feel less urgency for digital transformation, given that it is 12 times larger than its most formidable fintech competitor, Cash App’s B2C fiat division, which is growing at a modest 20%. However, digital transformation can still be justified in such cases due to challenges in launching even seemingly straightforward products. For instance, it took a decade for another major bank to replicate Bank of America’s Preferred Rewards program. U.S. Bank only recently introduced its 4% cash-back card on all purchases, available for customers investing $100K through the bank:

It took significant effort for U.S. Bank to break through internal siloes between its banking and investment groups, not just from a technological perspective but also to align on operating models and accounting treatment. Even something as simple as a unified dashboard displaying both banking and investment products took years for Bank of America to build for its Preferred Rewards customers.

The ultimate justification for digital transformation is to monetize internal platforms, a common dream for ambitious FSI CEOs. However, convincing competitors to pay for your products while their developers admire your API’s elegance is a daunting challenge with few success stories globally.

For years, Wise, one of the most capable fintechs worldwide, has aimed for its platform business to eventually surpass direct volumes. Despite signing over 90 clients since 2016, Wise’s Director of Finance, Martin Adams, recently described the contribution of the Platform division in an interview with FXCintelligence as "very small" and "not having a significant impact."

One notable exception with material business impact is MoneyLion, whose platform business generated $45 million in the most recent quarter, growing 18% QoQ. Of course, the world’s most renowned example is BlackRock’s Aladdin platform, which brings in approximately $1.5 billion in annual revenue—though it took a couple of decades to achieve this scale. With so many proven options for justifying digital transformation, does your FSI really need to keep relying on “smoke and mirrors”?

GenAI in FSIs: Balancing Customer Needs and Internal Complexities

GenAI hype remains strong, with FSIs increasing investments and vendor valuations soaring. However, the claims about its impact are becoming more grounded. Unlike in early 2023, we no longer hear mainstream warnings of an imminent Skynet-level event or the idea that mastering Prompt Engineering (or becoming an "AI whisperer") could somehow solve unstructured or missing data issues without coding skills.

It’s especially refreshing to hear CIOs of large FSIs bring a dose of reality, despite their general enthusiasm for novel tech and incentives to boost budgets. Tokio Marine’s CIO, Robert Pick, has been a consistent voice of common sense, recently sharing his views on Prompt Engineering in Modern Insurance Magazine:

Given concerns about GenAI's model stability, accuracy, and cognitive limitations, the use cases in production tend to be more organic than revolutionary. Celent’s recent report on real GenAI use cases among leading payments companies reveals that, for now, everything in production remains focused on extending ML capabilities and improving staff productivity across the board—from IT to marketing. The front-end productivity enhancements are typically classified as revenue growth, though this categorization isn’t entirely accurate.

In addition to design limitations, GenAI’s success in FSIs with customer-facing use cases is constrained by, well, customer preferences. In a surprising blow to digital influencers, top U.S. banks continue to promote massive branch expansions. In a recent announcement, Alex Overstrom, head of Retail Banking at PNC Bank, expressed being "beyond excited" to invest $1.5 billion in over 200 new branches.

The driving force behind such significant investments in offline channels is customer needs. Across both consumer and business segments, the shift to digital engagement for various products has been gradual, increasing only by a few percentage points annually. A recent Bain survey found that while consumers are more digitally inclined than SMBs, offline sales engagement remains substantial—30% to 50% for products like checking accounts and credit cards (60% to 80% for SMBs).

As in the 20th century, cash remains king for instant cross-border C2C transfers. This challenges the "money should be like email" rallying cry of fiat and crypto fintechs. For money transfer operators, physical cash has always been more tangible than digital money, and they've been willing to deliver it instantly—before PayPal.

The top-line case for generative AI might have been clearer if the unit economics of traditional channels were significantly inferior to digital. However, during a recent earnings call, Intermex executives highlighted the difference in cash and digital handling for a simple $400 cross-border money transfer, where digital is expected to excel:

Cash: Gross: $12.40 ($10 fee, 60 bps FX) - Costs: $7.25 ($5.25 to retail agent, $2 to payer) = Margin: $5.15

Digital: Gross: $11 - Costs: $5.70 ($2.50 processing, $3.20 chargeback losses and payer commission) = Margin: $5.30

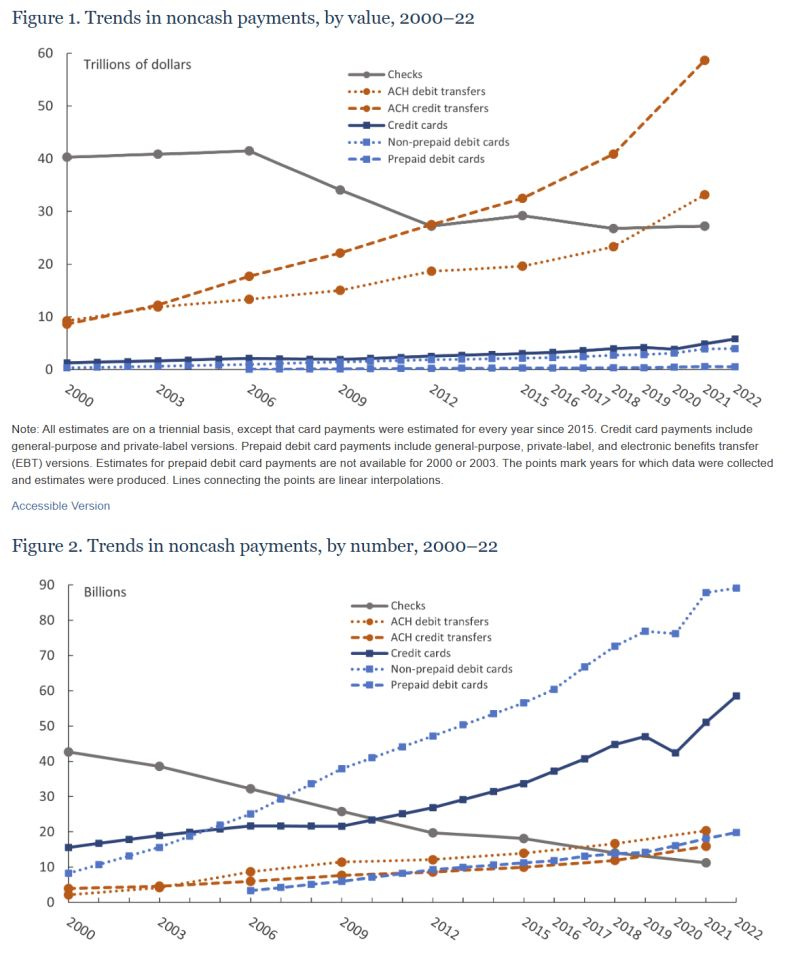

Even products like domestic checks in the U.S., which may seem anachronistic, are not disappearing due to the needs of certain segments. According to a recent Federal Reserve Payments Study, while check transactions halved over the last decade, their overall value has remained steady, as the decline mainly affected small consumer payments.

The limitation of clear use cases for Generative AI, primarily focused on productivity improvement, is also influenced by the immense complexity of FSIs' internal environments. As GenAI productivity use cases proliferate, unfamiliar technology will be layered on top of already fragile systems. Scotiabank recently raised eyebrows when it warned that routine maintenance would take four days over the Remembrance Day holiday. After a week, some customers were still unable to access their credit card accounts.

The proven approach for FSIs is to prioritize productivity-centered GenAI use cases in areas with high digital maturity and pursue only a few initiatives in parallel. It’s also perfectly fine to wait until leading FSIs prove ROI first. In the meantime, there are always opportunities to pilot simple yet valuable solutions.

For instance, MoneyGram recently shocked its customers by providing infrequent updates when its service went down for days due to a cyber attack. With a simple GenAI tool, FSIs could address such capability gaps by notifying customers in multiple languages about product inaccessibility as frequently as users prefer.