Forget Disruption by Startups; Some Traditional FSIs Are Gaining Market Share

Also in this issue: Nobody Understands Payments, Including You and Me - Crypto/Blockchain Edition

Forget Disruption by Startups; Some Traditional FSIs Are Gaining Market Share

Like the prediction of climate catastrophe from global warming, the disruption of FSIs by startups is always a decade away. The evergreen prophecy suggests that traditional FSIs are irredeemably costly, slow, and with 1970s tech; hence, their susceptibility to disruption is imminent. The only evidence we hear from those "experts" is that after a decade, some of those startups generate revenues on par with the top-10 traditional players and are profitable.

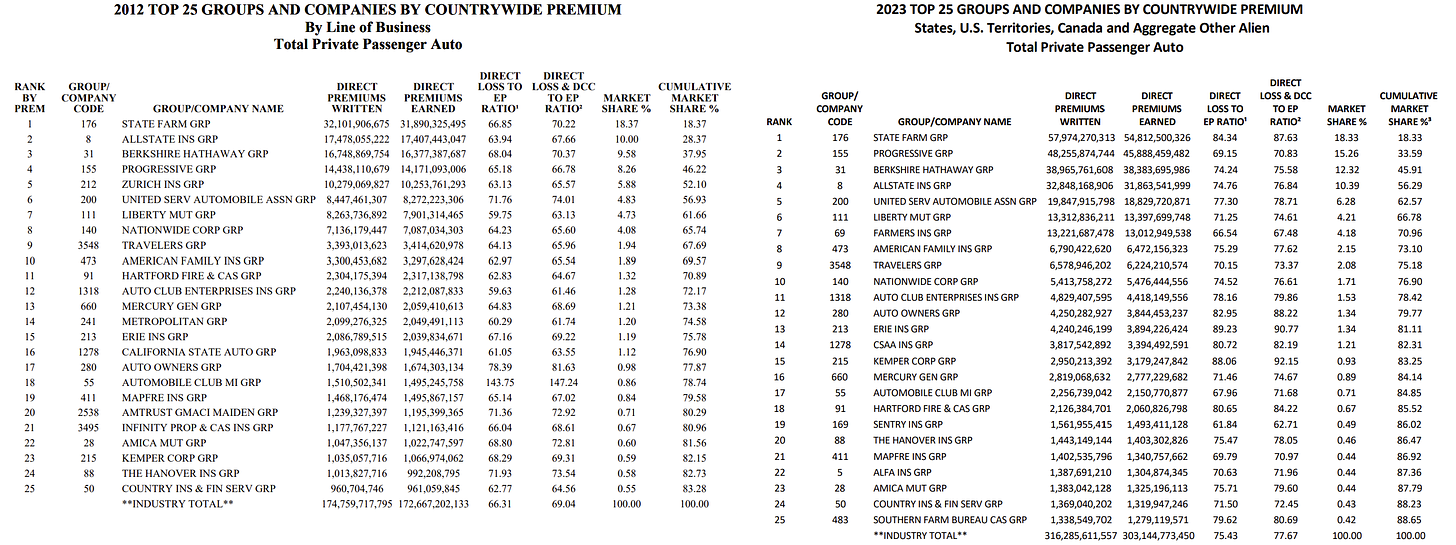

Such black-and-white thinking views FSI verticals as fixed markets and traditional FSIs as mostly unable to evolve. The reality is much more nuanced. For example, in the US consumer auto insurance between 2012 and 2023, Progressive increased its market share by 7%, moving from the #4 to the #2 spot:

However, gaining significant market share in the expanding market does not necessarily mean that other top players are being disrupted. Progressive's ascent was well deserved due to its superb data and analytics capabilities; however, it hasn't negatively impacted the market share of its main competitors: State Farm, GEICO, and Allstate.

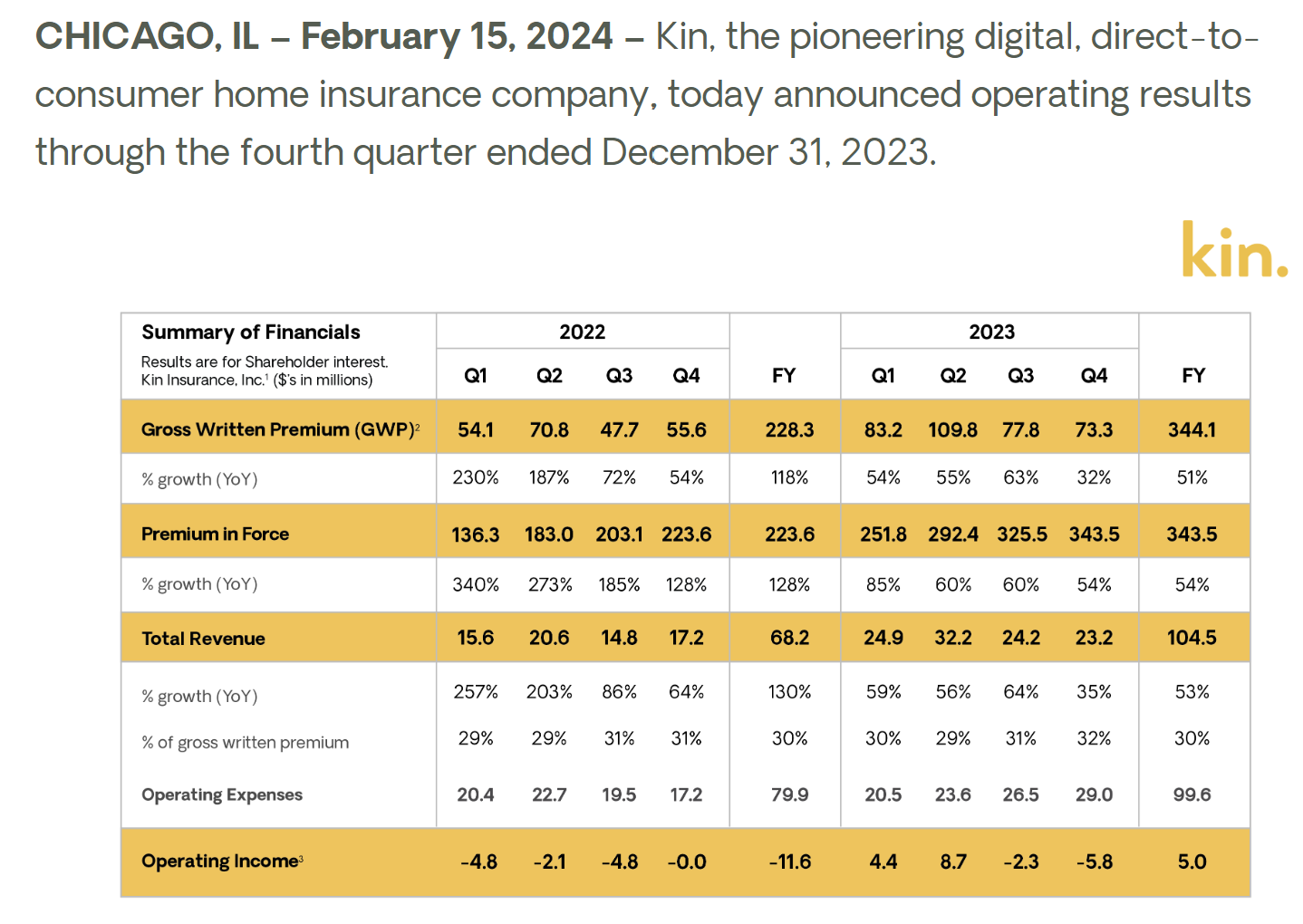

At the same time, most startups are struggling to maintain rapid growth while reaching profitability. Kin, a home insurtech company in the US, is a typical illustration of such phenomena. After 7 years since its launch, Kin is 30 times smaller than the incumbents in its vertical, and in the last quarter, its growth rate halved, while it lost money in the last two quarters:

Real Differentiation vs. Hollow Innovation

Some traditional FSIs adeptly retain their market position, even expanding it, vis-à-vis startups, by evolving their digital capabilities while preserving mastery in traditional domains:

Augmenting and replacing legacy technology with modernization and partnerships;

Improving accessibility and analytics for decades of transaction data; and

Augmenting traditional pricing and client support with novel models.

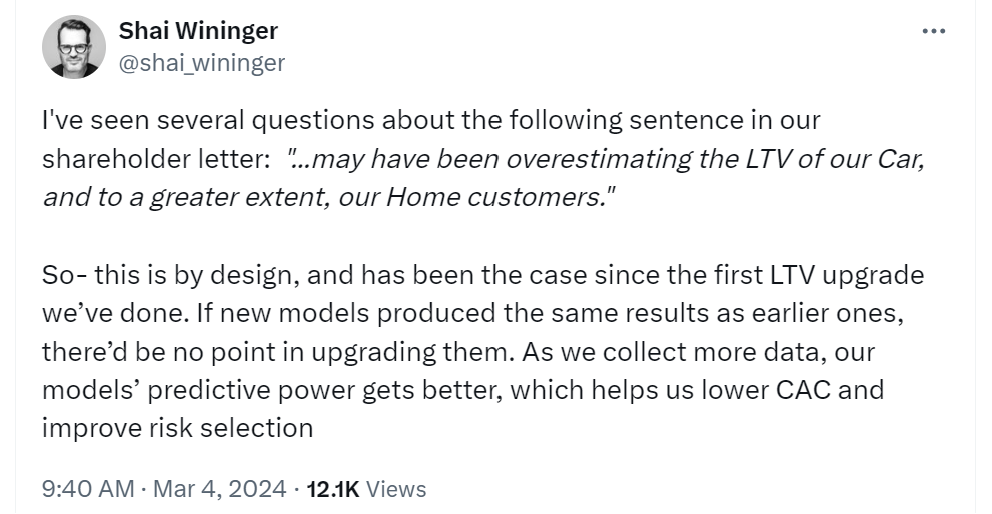

What can startups bring against such incumbents? Launching twice as many features only to realize years later that most of them are used by less than 1% of customers. That explains how an AI-native insurtech like Lemonade, with a tech stack less than a decade old, managed to lose 90% of its company value since its highs. As its Co-Founder and CEO recently illustrated, all those shiny capabilities did not help predict the right customer value:

Without having the same wealth of data as incumbents, startups like Lemonade are more likely to target the wrong customers with the wrong pricing. It's nice that they are fast learners and adjust their models, but unfortunately for them, Progressive isn't using an abacus to evolve their LTV and CAC estimates either.

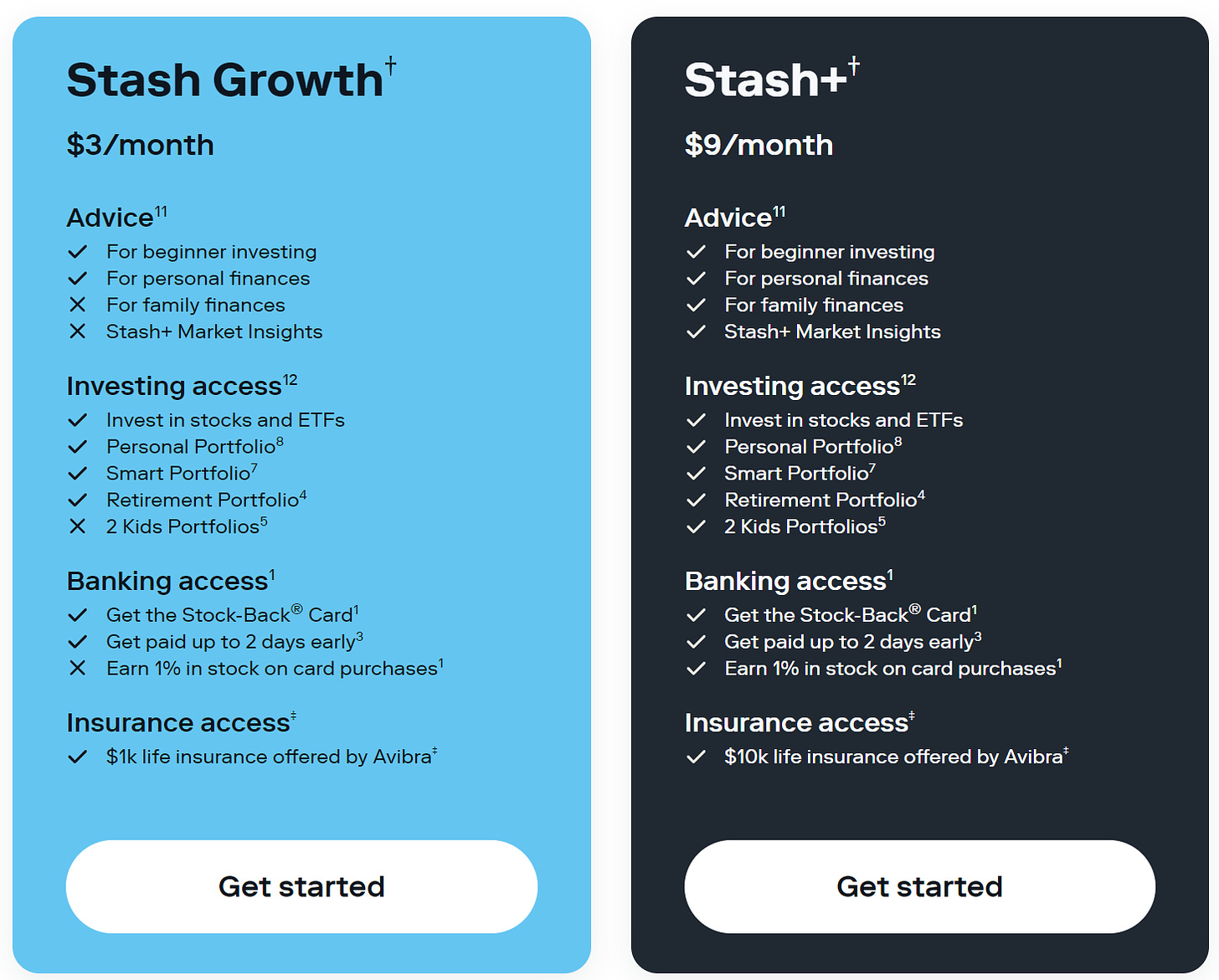

Business model innovation by startups might also seem helpful, but only if it offers differentiation for consumers. Fintechs like Stash have seen massive layoffs from their 2021 peaks because their interesting subscription model mostly offers what consumers could get from incumbents like Fidelity for free:

Playing to Traditional Strengths

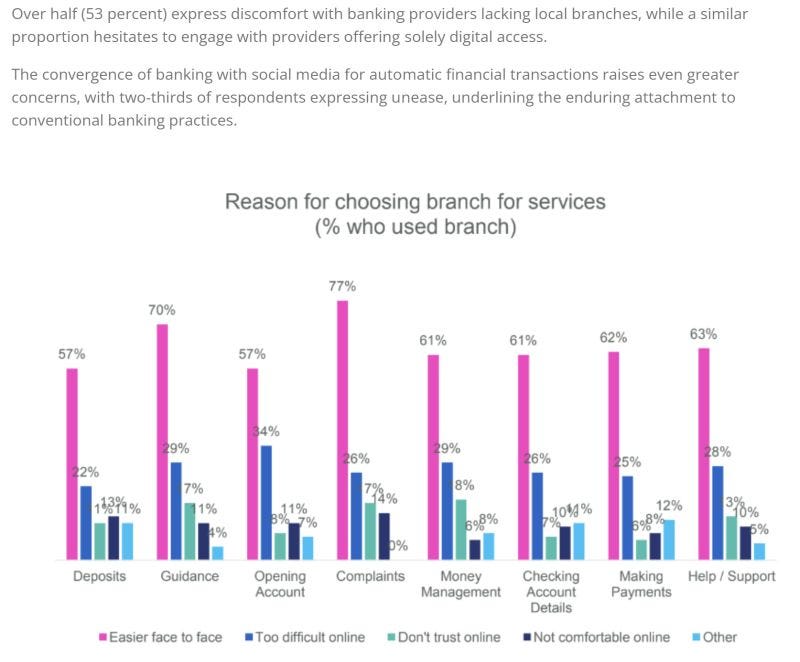

Moreover, Tradfi Derangement Syndrome (TDF) makes fintechs and insurtechs susceptible to neglecting customer needs, including those of the younger generation, who continue to crave traditional support. In a recent global survey by EPAM, 83% of consumers were happy with their primary bank, with less than 5% experiencing annual attrition. Even in Singapore, arguably the world's brightest and most digitally savvy population, half of consumers hesitate to bank with providers without local branches:

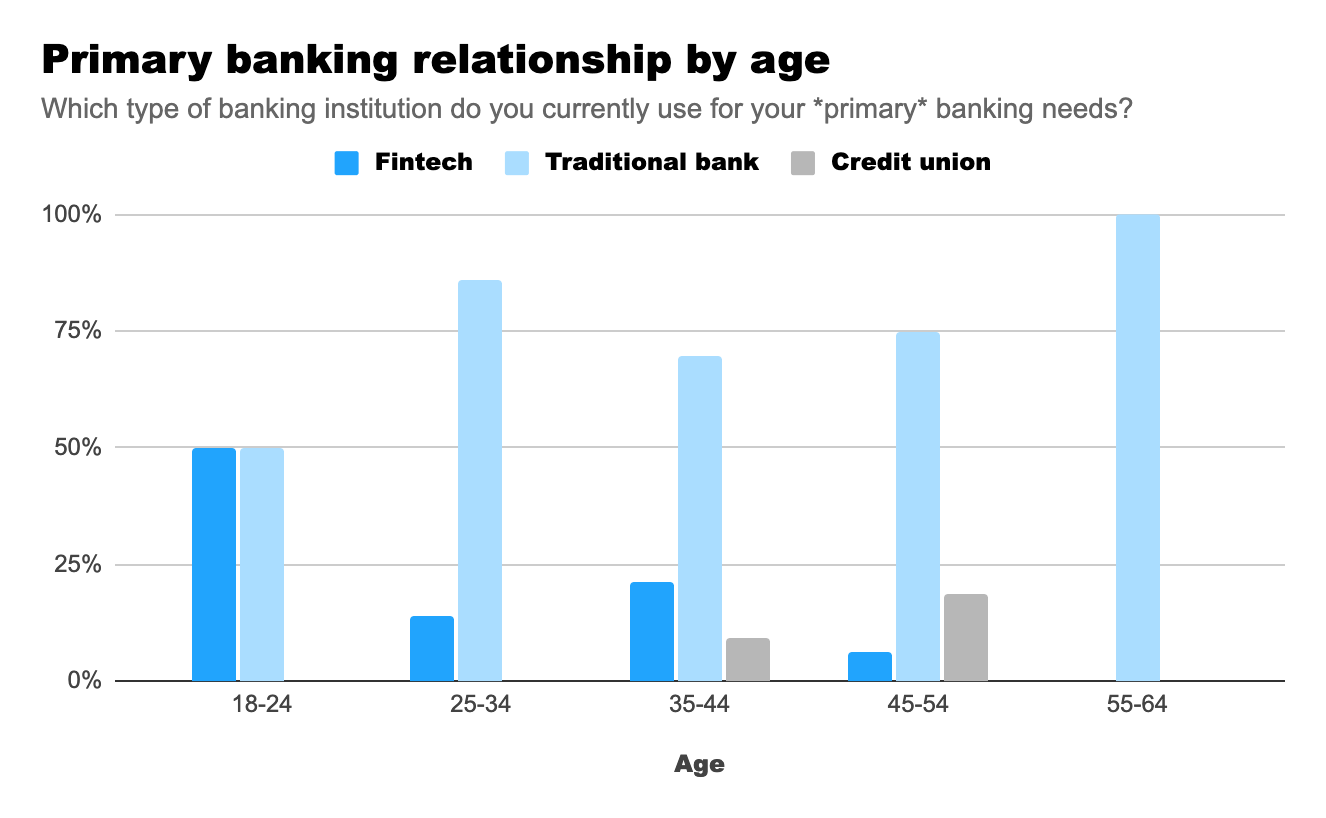

Such a preference for traditional FSIs is not just prevalent among regular consumers. In a recent survey of fintech employees, the majority had a primary relationship with a traditional bank:

Rather than worrying about and trying to mimic always-a-decade-away disruptors, traditional FSIs should play to their traditional strengths while selectively pursuing digital transformation with a clear ROI. Remember that there are plenty of examples where the traditional approach has generated 10X value compared to startups and gained market share:

Targeting a riskier client segment

Implementing roll-ups in a niche segment with mastery of integration

Offering solutions in an area with high regulatory uncertainty

Monetizing status signaling

Find a legal way to help wealthy folks avoid paying taxes through fancy life insurance, and you could make a killing while using fax machines. FSI executives who only focus on digital opportunities out of fear of imminent disruption may think it makes them futurists, but these days it is a sign of lacking imagination.

Nobody Understands Payments, Including You and Me: Crypto/Blockchain Edition

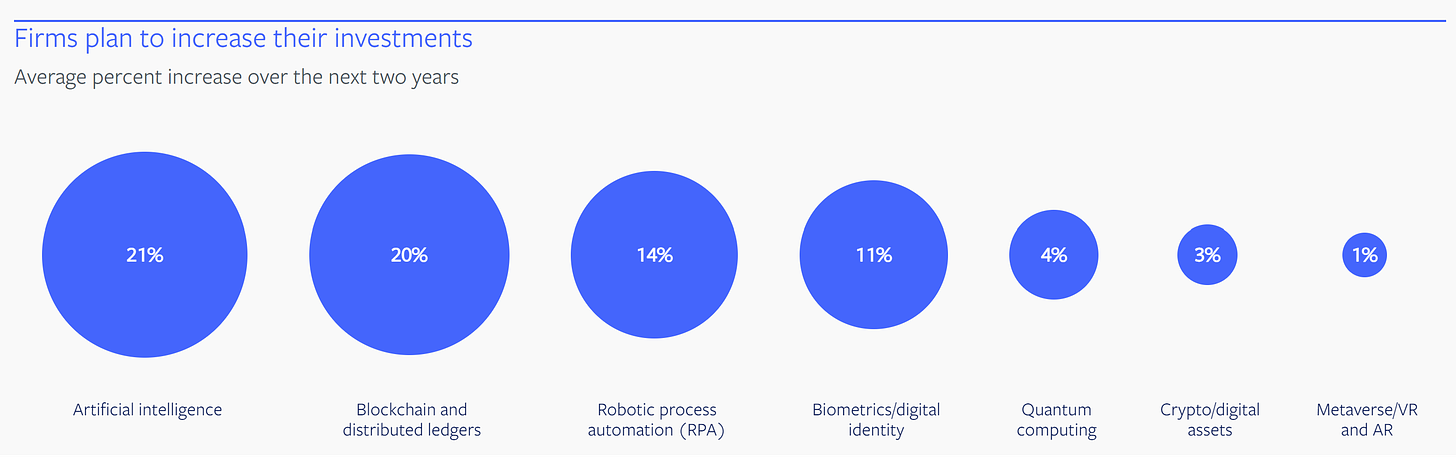

"I stopped following Crypto and Blockchain, including government efforts. For our cross-border needs, Visa Direct is more than sufficient," explained the Head of Product of a global fintech. With Blockchain back in the news, it was ironic to hear a fintech executive being less enthusiastic than some traditional FSIs. In a recent global survey of FSI executives, Blockchain was surprisingly named on par with AI as an area for increased investment:

Why is Blockchain making a comeback now? Just as the Generative AI hype peaked in 2023-2024, the initial surge of interest among FSI executives in Blockchain emerged during 2016-2017. Without much understanding of what it is and how it will make them money, FSIs wisely put in $250K-$1M while periodically producing press releases about bogus use cases and partnerships. However, this Blockchain cycle feels more than just R&D theatrics for PR purposes.

Have FSI executives gained a better understanding of the use cases since 2017? In recent conversations, they appear even more confused. The proliferation of coins, protocols, and exchanges has become increasingly complex, exacerbated by numerous countries sponsoring their own central bank coins and blockchain projects. There are indeed real use cases, albeit often criminal, such as money laundering or evading sanctions. However, some of the most discussed legitimate use cases are often based on an inadequate understanding of payment complexities and the rapid evolution of traditional payment systems.

Are Consumers Being Neglected by Traditional Payments?

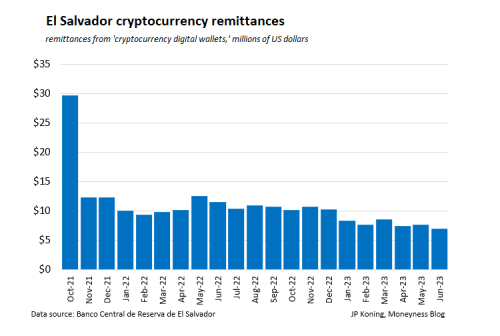

Fiat-centric efforts by fintechs, telecoms, and governments have driven remarkable acceleration to accessible finance in developing markets such as China, India, Kenya, and Brazil over the last two decades. Crypto? Not so much. The usage in El Salvador, the world's most prominent supporter of Crypto for buying goods and money transfers, has collapsed since its launch:

The most common legitimate use case has remained an investment and trading by well-off consumers. A decade ago, the hope was that at least Bitcoin could offer diversification against main asset classes, but the reality has proven to be more banal. Bitcoin's price has been correlated with indices like the S&P 500 but as a more speculative asset - it would be bought when that consumer segment has earned extra gambling money and sold when the US economy might be turning for the worse.

It's fine that Blackrock and other funds want to monetize speculative hype with a higher expense ratio. The Bitcoin ETF's AUM has already crossed $60 billion just after two months. At the same time, mission-driven FSIs that have the long-term interests of consumers in mind have stayed away, as was recently explained by Vanguard's CEO:

Are Traditional Payments Outdated?

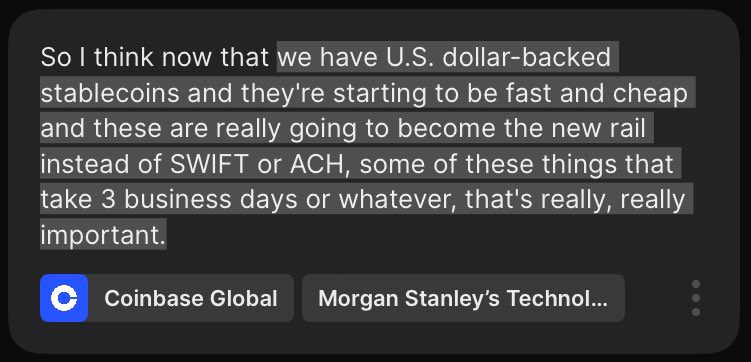

Most crypto executives and experts have spent the last decade under the delusion that fiat-based payments are irredeemably backward. Such individuals, like the CEO of Coinbase, feel compelled to keep asserting this belief, or they won't be able to pretend that they are doing something groundbreaking:

Those claims are then spread uncritically by other crypto experts and operators. A recent funny example came from PayPal stating that it is about to leverage its stablecoin, PYUSD, for free cross-border money transfers within its subsidiary, Xoom:

Of course, the service isn’t going to be free. Xoom is already making twice as much money on the FX markup, and it could simply increase this further while eliminating more visible fees. But, more interestingly, none of those crypto experts wondered why Xoom customers were asked to select a stablecoin rail as a payment method. If it was so much faster and cheaper than SWIFT and ACH, why wouldn’t PayPal just replace those methods for all transactions? It’s not like consumers know or care which back-office protocols a company uses to provision their financial or insurance services.

The answer is straightforward - PayPal hopes to be in the traditional money printing business. Possessing its own printing press for novel coins that individuals are willing to exchange for fiat currency represents an unparalleled business model. PayPal seeks to encourage Xoom customers to exchange fiat into their coin and potentially retain some of it. Furthermore, such PR efforts create the perception of a genuine use case for their stablecoin, finally making it a worthwhile investment.

In the real world, fiat payments have been revolutionized in the last decade, in part spooked by the threat of Blockchain. For example, SWIFT has scaled new data-rich solutions for large and small amounts (GPI and Go), with 50% of GPI payments credited to end beneficiaries within 30 minutes.

In certain areas, fiat-centric payments have advanced too much and are now experiencing a rollback. The UK, a global leader in real-time payments, mandated banks to process payments within seconds. However, crime syndicates eventually exploited this system. The concept of "Money movement should be free, real-time, and accessible to everyone!" sounds awesome, provided FSIs absorb all associated risks. However, they are reluctant to embrace this idea for some reasons. Consequently, the UK government intends to roll back the requirements, permitting banks to delay payments for up to four days if fraud is suspected.

Are FSIs and Businesses Eager to Embrace Blockchain?

Another often-discussed Blockchain use case is the tokenization of assets. Instead of physically moving assets for trading and lending purposes, financial institutions could digitize them with tokens, creating shadow books. By October 2023, four years after its launch, JPM Coin usage alone amounted to $1 billion in daily transactions.

Of course, as with any new currency and protocol, they are only as valuable as their virality. The business case for JPM Coin to persuade its peers and regulators to become a standard is unknown for now. The same goes for other similar efforts worldwide, as recently noted by Swift:

However, if Blackrock managed to persuade its peers to buy its Aladdin platform to the tune of more than a billion dollars annually, perhaps JPMorgan could accomplish a similar feat with its token.

Will Struggling Countries Allow Distributed Control of FX?

Developing countries also offer fertile ground for hypothetical Blockchain use cases. This is where we've witnessed the most dramatic shifts in payments over the last two decades. However, this transformation has been primarily driven by the absence of robust banking infrastructure and large segments of the population lacking banking accounts. Through the collaborative efforts of government, fintech, and technology/telecom players, these markets have become highly competitive. In certain payment features, countries such as China, India, Russia, and others in the developing world are notably ahead, with higher adoption rates compared to the West.

The most prevalent remaining use case for cryptocurrencies is in countries facing high inflation and stringent capital controls. Growing up in the Soviet Union, the official exchange rate was 0.6 ruble for a dollar, but to actually buy it, I had to go to a physical black market and pay 25 rubles. Crypto exchanges make such markets much more accessible than in the 20th century. However it is not achieved through some innovation unattainable to fiat exchanges, but through the circumvention of capital controls.

Governments in those countries could be sufficiently inept and corrupt to let this fester for a while. However, as the US government eventually got to FTX executives despite tens of millions in political donations, crypto exchanges are at risk in developing countries as well:

Payments: The Trickiest Use Case for Digital Transformation

In the context of digital transformation, payment use cases should be chosen with extra caution, if at all. This sector garners significant interest from governments, competitors, fintechs, and digital natives, often without a clear understanding of ROI. Payments also tend to represent a race to the bottom, with new disruptors emerging every few years with leaner business models, as exemplified in the case of cross-border money transfers:

Banks ← Western Union ← Xoom ← Wise ← Atlantic Money

Careful selection of internal and external experts is crucial. Begin by asking them the following three questions:

Who is the leading player monetizing that use case?

How much revenue have they generated from this use case, and how fast is it growing?

Who are the typical users, and what is their top reason?

In most cases, the answers would be murky, especially from anyone claiming to understand multiple payment use cases. Instead, FSIs should address the top complaints about payments from their core client segment and hold off on introducing new payment features, especially if they are blockchain-based.